Sociology offers valuable insights into various aspects of society, including economic activities that may not always be visible or officially recognized. One such phenomenon is the black economy, which refers to a range of informal, illegal, or unregulated economic activities that operate outside the boundaries of the formal economy. In this article, we will outline and explain the concept of the black economy in sociology.

Defining the Black Economy

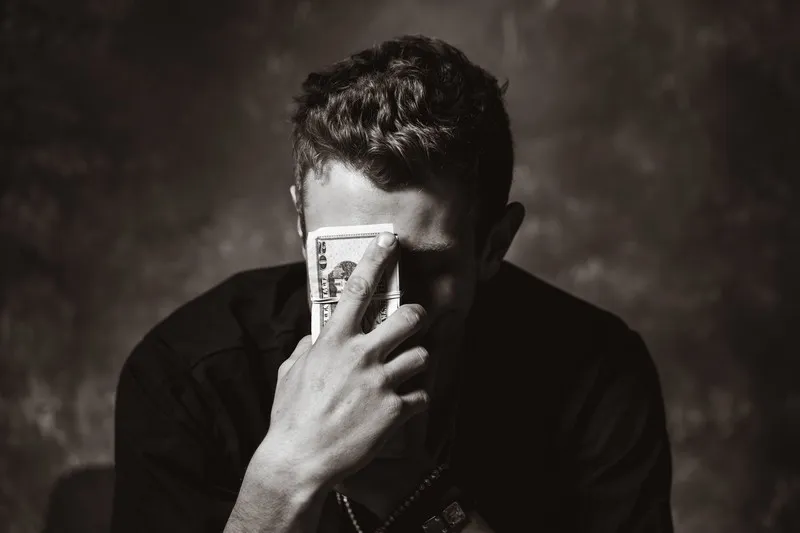

The black economy, also known as the underground economy, shadow economy, or informal economy, encompasses a wide range of economic activities that are not accounted for in official statistics or regulated by the government. These activities often involve the production, distribution, and consumption of goods and services that are not reported to authorities or subject to taxation.

The black economy can take various forms, such as undeclared work, unregistered businesses, tax evasion, money laundering, smuggling, and illegal trade. It operates outside the legal framework and can involve both legal and illegal goods and services.

Causes and Factors

Several factors contribute to the existence and growth of the black economy:

- High Taxation: Excessive tax burdens and complex tax systems can incentivize individuals and businesses to engage in tax evasion or undeclared work to reduce their tax liabilities.

- Regulatory Burdens: Excessive regulations, bureaucratic red tape, and high compliance costs can push individuals and businesses into the informal economy, where regulations are less stringent.

- Poverty and Unemployment: Economic hardships, lack of job opportunities, and poverty can drive individuals to participate in informal economic activities as a means of survival.

- Corruption: Widespread corruption within the government and law enforcement agencies can facilitate the growth of the black economy by enabling illegal activities and protecting those involved.

- Globalization and Migration: Globalization and increased migration can create opportunities for illegal trade, human trafficking, and other forms of illicit economic activities.

Social Implications

The black economy has significant social implications:

- Loss of Government Revenue: The non-reporting and non-payment of taxes result in the loss of government revenue, which could have been used for public services, infrastructure development, and welfare programs.

- Increased Inequality: The black economy often perpetuates income inequality as it primarily benefits those who can evade taxes or exploit cheap labor, while disadvantaging those who rely on formal employment and pay their fair share of taxes.

- Exploitation and Informal Labor: Many individuals engaged in the black economy, such as undocumented workers, may face exploitative working conditions, low wages, and lack of legal protections.

- Undermining Formal Economy: The black economy can undermine the formal economy by creating unfair competition, distorting market dynamics, and eroding trust in the rule of law.

- Increased Crime and Insecurity: Illicit economic activities associated with the black economy, such as money laundering, drug trafficking, and smuggling, can contribute to increased crime rates and social instability.

Addressing the Black Economy

Addressing the black economy requires a comprehensive approach that involves legal, economic, and social measures:

- Effective Taxation and Regulation: Simplifying tax systems, reducing tax burdens, and streamlining regulations can incentivize individuals and businesses to operate within the formal economy.

- Combating Corruption: Strengthening anti-corruption measures, improving transparency, and holding accountable those involved in facilitating the black economy can help reduce its prevalence.

- Investing in Education and Job Creation: Providing quality education, skills training, and job opportunities can reduce the socio-economic factors that drive individuals into the black economy.

- Focused Law Enforcement: Improving law enforcement capabilities, cooperation between agencies, and international collaboration can help combat illicit activities associated with the black economy.

- Public Awareness and Social Support: Raising public awareness about the negative consequences of the black economy and providing social support to vulnerable individuals can help discourage participation in informal economic activities.

In conclusion, the black economy represents a complex socio-economic phenomenon that exists parallel to the formal economy. Understanding its causes, implications, and potential solutions is crucial for sociologists and policymakers alike. By addressing the underlying factors and implementing effective measures, societies can strive towards a more inclusive and equitable economic system.